‘Bail-in’: They Plan to Steal Your Personal Bank Deposits and Pensions!

This article was originally issued as a Citizens Party (then Citizens Electoral Council) media release on 22 March 2016, and has been edited and updated.

The world is hurtling towards a far worse financial collapse than even the crash of 2008. An unprecedented stock market bubble and bloated debt balance sheets in areas ranging from corporate debt to real estate markets to consumer borrowing, throughout the Transatlantic sector of the world economy (and those attached to it, including Australia and New Zealand), have brought authoritative warnings of the next, looming megacrash, while the actions of the transnational financial authorities demonstrate fast-growing desperation on their part. Foremost among those actions is “bail-in”, the asset-confiscation model that got its test run in Cyprus in 2013.

In 2008, the international financial oligarchy, centred on the British Crown, the City of London, and Wall Street, had directed terrified governments to spend tens of trillions in public funds to “bail out” so-called too-big-to-fail (TBTF) banks, whose quadrillions of dollars in speculation had caused the crisis in the first place. In the years since, those banks have not stopped their unbridled speculation, nor their drug-money laundering, terror-financing, tax evasion and other criminality; the tens of billions of dollars in fines incurred for such activity are simply written off as a cost of doing business.

But, bailouts were not enough. While hiding behind sophistical declarations of a desire to avoid 2008-style taxpayer bailouts in the next crisis (which their own policies were making sure would come), the Bank for International Settlements (BIS) and its Financial Stability Board (FSB) developed plans to simply seize private assets, including the bank deposits of ordinary citizens—“bail-in”, as opposed to “bail-out”. The FSB was established at the April 2009 London Group of 20 summit to effect the G20’s “post-crisis reforms”, with protecting the existing global financial system its first priority. In October 2011 the FSB adopted its policy document “Key Attributes of Effective Resolution Regimes for Financial Institutions”, a global template for applying bail-in to failing TBTF banks.

The rationale for bail-in goes like this. When a bank fails because its assets (such as mortgage loans) are not enough to cover its liabilities, rather than its being declared bankrupt or bailed out with taxpayer money, the bank will be kept open for business by the intervention of a government-appointed bail-in authority, which takes over the bank and acts to reduce its liabilities. The authority will write down (cancel) some of the value of the bank’s debt. Creditors, such as holders of the bank’s bonds, may have those bonds converted into equity (shares) in the bank. Not only bondholders, but also depositors are classified as “unsecured creditors”. Thus, to reduce the bank’s liabilities the bail-in authority can vaporise the savings of its customers and assets of its bondholders, compensating them with worthless shares in the “resolved” institution.

“Bail-in” regulations, as designed by the Bank of England, the BIS, and the FSB, define a wide range of confiscatory actions. In order to build buffers against losses from their huge speculative activities, banks are required to sell “bail-in bonds” (also called “hybrid securities”), which carry the provision that they will be written down and/or converted to shares in a crisis, effectively becoming worthless. These are typically sold to large and presumably “knowledgeable” investors such as insurance and pension/superannuation funds, but sometimes, as in Italy and Australia, they are sold directly to unsuspecting individual savers and investors as inherently safe. One way or the other, whether through simple stealing of individual bank accounts or large-scale looting of superannuation funds, the architects of bail-in emphasise that individuals will be forced to pay.

At a 5 November 2014 forum in Washington, DC, on the 2010 Wall Street Reform and Consumer Protection (“Dodd-Frank”) Act, which enshrined bail-in in the USA, former Bank of England Deputy Governor Sir Paul Tucker, one of the architects of bail-in, declared that for a permanent bail-in system to work, the burden of keeping the banks from failing must fall on households, through their superannuation and insurance funds which hold bail-in securities. “You absolutely can’t allow banks and shadow banks to hold it”, Tucker insisted. “So that leaves you with insurance companies, pension [superannuation] funds, mutual funds, etc. And when I’ve said that in other groups, people have said, ‘My goodness, it’s households!’ ... Well, there are only households ... Do you want all the risk to fall back on Wall Street firms?”

On 1 January 2016 new bail-in regulations with the force of law took effect throughout the European Union. The EU’s Bank Recovery and Resolution Directive (BRRD) allows TBTF banks to seize personal bank deposits. The UK, whose Bank of England (BoE) was the BRRD’s principal author, had put the new law fully into effect already on 1 January 2015.

Attempts during 2013-15 to pass bail-in legislation in Australia were defeated by the Citizens Party's (then Citizens Electoral Council’s) mass mobilisation. The Australian Prudential Regulation Authority (APRA) then declared, fascist-style, that it could impose bail-in without legislation;[1]nonetheless, APRA’s international masters continued to demand that the practice be legitimised through legislation. Although none of the 30 megabanks classified by the BIS as Global Systemically Important Financial Institutions (G-SIFI) is Australian, each of Australia’s Big Four banks is among the top 50 banks worldwide. Therefore Australia’s financial system as a whole is ranked by the IMF as “systemically important”, meaning that a banking crash in Australia could bring down the entire Anglo-American system.

Bail-in devastated the nation of Cyprus in 2013, an experiment which the president of the Eurogroup of European finance ministers, Jeroen Dijsselbloem, proclaimed to be the “template” for the entire EU. Since then it has been applied to a lesser, but still disastrous, effect in Portugal, Spain and Italy.

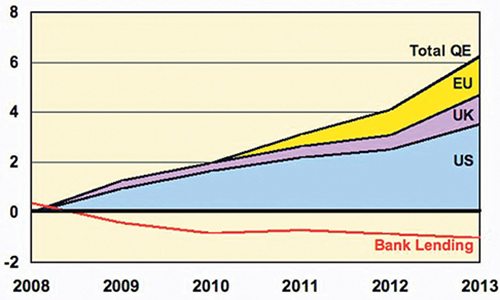

In reality, bail-in cannot save the TBTF banks: the amount of depositors’ funds available to be seized is so small in comparison to the amount of speculative debt held by the banks, that governments will be forced once again to cough up untold trillions in “bail-out”, on top of “bail-in”. In addition, the very spectre of bail-in destabilises financial relations. For example, in early 2016 the fact that bail-in was now on the books so terrified investors about being “bailed in” in the future, that they drastically cut back on bond purchases; the collapse of bond markets was a major factor in the drastic 10 March 2016 decision of the European Central Bank (ECB) to pump money into the big banks through zero and negative interest rates and increase quantitative easing—the ECB’s own bond purchases—by one-third, to 80 billion euros per month, a rate of money-pumping greater than the U.S. Federal Reserve System’s QE at the height of its post-2008 interventions.

But bail-in is not merely, or even mainly, a “financial” trick. Its design is political. The real agenda behind bail-in is the intention of the Crown/City of London/Wall Street cabal to enact fascist police-state regimes and reduce the population throughout the Western world, even as they gun for a military showdown with Russia and China, to loot and subdue the BRICS nations (Brazil, Russia, India, China, and South Africa) before their own Transatlantic system collapses. The racist eugenics philosophy of the British Crown and its adjuncts underlies such measures as bail-in.

Bail-in: Derivatives Come First

The financial instruments known as “derivatives” lay at the heart of the 2008 Global Financial Crisis (GFC). The TBTF banks had concocted hundreds of trillions of dollars in these speculative gambling bets on everything imaginable: changes in interest rates and the value of currencies; farm and other basic commodity prices; dodgy mortgages; stock market indices; and even the weather. The nominal value of derivatives has no tangible backing; they are contracts that promise future pay-outs to their purchasers, depending on what happens with what is being bet upon—either changes in the price of a commodity or financial instrument, or some other process. They are acquired by investors for amounts far smaller than the nominal value, in a matter somewhat analogous to, but much worse than, buying stock on margin. Quite apart from the staggering amount of outright fraud involved in derivatives today, such financial gambling bets were strictly illegal during most of the post-war period, because they would prey upon and disrupt the flow of credit to the real physical economy.[2] The speculative bubble of derivatives was estimated at nearly US$1.2 quadrillion (a thousand trillions), against a world GDP of only US$60 trillion, when it triggered the 2007-08 crisis. The TBTF banks of London and Wall Street threatened to fall like a row of dominoes, with the City of London—the centre of the world derivatives trade and the place where the crisis began—admitted to being in far worse shape than even Wall Street.

Because the TBTF banks lend almost solely to each other, and not to the real economy, if the derivatives bets of even one of them go sour, the whole global system will blow.[3] The closing of such a bank even for a few days could set off a chain reaction. Therefore the Bank of England and its flunkies at the Bank for International Settlements concocted the bail-in scam. “Open Bank Resolution”, the name given to the scheme in New Zealand,[4] is descriptive: the bank remains open for business during the process. Instead of a normal bankruptcy proceeding, in which a hopelessly bankrupt bank is wound up and closed, and its creditors are paid from whatever is left of its assets (“closed bank resolution”, so to speak), bail-in laws and decrees provide for failing TBTF banks to be reorganised over a weekend, in order to keep them open for business on Monday.

Under traditional bankruptcy law in Australia, the UK, the USA and elsewhere, depositors had first claim on any remaining assets of a bank that folded. Under bail-in, however, because bondholders and depositors are classified as “unsecured creditors”, the bail-in authorities will simply write off whatever percentage of the bank’s bonds and deposits they deem necessary and/or convert them into illiquid or even near-worthless equity in the salvaged bank. This process, called “recapitalisation”, has already happened in EU countries where bail-in has been applied. But there is an additional, crucial feature embedded in the now global bail-in model: derivatives are prioritised above any other claims, specifically including deposits. This provision, known as the “super-priority of derivatives”, explicitly exempts them from being bailed in.

In the United States, derivatives obligations were given super-priority status already in 2005 under the Bankruptcy Abuse Prevention and Consumer Protection Act; this status was continued under the 2010 Dodd-Frank Act, which excludes them from being bailed in. The EU’s BRRD exempts derivatives from bail-in unless they have first been “closed out”, and requires national regulators to exempt certain liabilities so as to “avoid giving rise to widespread contagion”. In effect, this exempts all derivatives. A City of London banking source told the Citizens Party, “The rules on this [closing out of derivatives] are highly complex and there are fears in the financial markets that their operation could be severely disruptive if ever a bail-in situation arose.”

The decision to accord super-priority to derivatives is no surprise, because the two individuals credited with inventing the notion of bail-in, after the 2008 GFC, are Paul Calello and Wilson Ervin, top derivatives salesmen for Credit Suisse First Boston, a bank already notorious for derivatives fraud. Calello had been involved in winding up the U.S.-based hedge fund LTCM, whose failure almost brought down the world financial system in September 1998. Both Calello and Ervin were present at the infamous weekend meeting at the New York Federal Reserve in September 2008, where that year’s bail-out was plotted. Speaking on behalf of the failing system, Calello and Ervin floated the new bail-in scheme in an editorial in the 28 January 2010 issue of the City of London’s flagship magazine, The Economist. Thereafter, according to Ervin’s own account in a 12 March 2015 interview with the International Financial Law Review, titled “The Birth of Bail-in”, the model was championed by three individuals in particular: Mark Carney, the former Bank of Canada governor who took over as chairman of the BIS’s Financial Stability Board (FSB) in January 2011, and on 1 July 2013 also became governor of the Bank of England; Paul Tucker, the Bank of England’s deputy governor for financial stability; and Jim Wigand, director of the Office of Complex Financial Institutions of the U.S. Federal Deposit Insurance Corporation (FDIC).

Champions of Bail-in: Goldman Sachs, the Bank of England and the BIS

The careers of Carney and Tucker, foremost champions of bail-in, are a window into the world of the financial oligarchy.

For 13 years, Carney held top posts at the world’s largest and most notorious investment bank, Goldman Sachs, a major player in the subprime mortgage scam which led to the 2008 crash.

Goldman Sachs is arguably the world’s most powerful investment bank. Especially since the 1980s financial deregulation (London’s Big Bang stock market reforms and the U.S. Fed’s exemption of categories of over-the-counter derivatives trading from regulation), Goldman Sachs has been famous for exploiting political connections to fan speculative booms, extract maximum profits, and then get out of a given bubble before its inevitable bust, often at the expense of its own clients. This pattern was visible in the “tech” boom of the late 1990s, the sub-prime mortgage bubble of the 2000s, and the commodities bubble. Goldman has even positioned itself to become the biggest player in the next speculative bubble—carbon trading. The firm has earned its description by Wall Street observer Matt Taibbi (Rolling Stone, 5 April 2010) as “a great vampire squid wrapped around the face of humanity, relentlessly jamming its blood funnel into anything that smells like money”. Time and again, Goldman Sachs executives become very rich, and then take up regulatory and other government positions, from which they can ensure the game is rigged to benefit Goldman Sachs and its fellow financial predators.

Goldman Sachs alumni include Bank of England Governor and FSB Chairman Mark Carney; former FSB Chairman and current European Central Bank (ECB) President Mario Draghi; Robert Rubin, who as U.S. Treasury Secretary worked for the repeal of Glass-Steagall; U.S. Treasury Secretary Hank Paulson, who bailed out Wall Street in 2008; George W. Bush’s White House chief of staff during the 2008 crisis Joshua Bolton; Clinton Administration Treasury official Gary Gensler, who wrote the Commodity Futures Modernisation Act of 2000, excluding derivatives from regulation, and was a leading adviser to Hillary Clinton’s 2016 presidential campaign; and Australian Prime Minister Malcolm Turnbull, who made his fortune in the Goldman-manipulated tech bubble in the late 1990s.

In 2017 a flood of Goldman Sachs veterans into the Trump Administration in the United States worked against speedy action to implement measures Trump himself had campaigned for, but Wall Street opposes. Foremost among those issues is Glass-Steagall banking separation, to protect normal lending from disruption by financial speculation. Trump had advocated Glass-Steagall during the campaign, but his Secretary of the Treasury Steve Mnuchin, one of six “graduates” of Goldman Sachs named to Cabinet or White House staff posts, stated during his confirmation hearings that he had no intention of reinstituting the original Glass-Steagall. A second-generation Goldman Sachs man, Mnuchin worked for 17 years at the firm, before moving on to set up his own investment firm, specialising in mortgage-backed securities. Gary Cohn, head of Trump’s National Economic Council until April 2018, spent 25 years at Goldman Sachs, and was the firm’s chief operating officer. Short-lived Trump advisers Steve Bannon and Anthony Scaramucci also had worked at Goldman Sachs, as had Dina Habib Powell, Trump’s senior counsellor for economic initiatives during his first year in office. Head of the Securities and Exchange Commission Walter “Jay” Clayton was previously a partner at Sullivan and Cromwell, the powerhouse Wall Street law firm. His wife is employed at Goldman Sachs, and Clayton has represented Goldman Sachs, including during the Treasury Department bailout of Goldman Sachs under the Troubled Assets Relief Program (TARP) after the 2008 Wall Street collapse.

One of Carney’s Goldman Sachs positions was as its London-based co-head of sovereign risk for Europe, Africa, and the Middle East. That meant heavy involvement with derivatives, which were ostensibly invented to “manage risk”. As Canada’s Globe and Mail reported on 25 January 2008 in a profile of Carney, at the time just appointed as governor of the Bank of Canada, “some central bank watchers fear that the naming of Mr Carney as governor symbolises the supremacy of financial markets over the interests of employment and general economic health when it comes to central banking. And there’s no doubt that Mr Carney believes that markets should largely be left unhindered to determine the direction of the economy.” He was, noted the paper, an outspoken critic of nations attempting to “champion industrial policies”.

The Bank of England’s Paul Tucker was another heavy-weight. A protégé of Robin Leigh-Pemberton, BoE governor in 1983-93, for whom he worked as principal private secretary, Tucker was the BoE’s deputy governor for financial stability in 2009-13, in 2012-13 simultaneously serving as head of the BIS Committee on Payment and Settlement Systems (subsequently renamed the Committee on Payments and Market Infrastructures). Tucker had been deemed a shoo-in to take over as governor of the BoE in 2013, but a scandal over his intimate relations with certain bankers involved in rigging the LIBOR rate, whereas he was responsible for monitoring such things, opened the position for his BIS mate Carney.

Carney’s heading both the BoE and the BIS’s Financial Stability Board, established by the G20 nations in 2009 to prepare measures to avoid another 2008 crash or worse, is fitting, since the Bank of England established the Bank for International Settlements in 1930 to be a “central bank of world central banks”. Reflecting long-time BoE Governor Montagu Norman’s support for Hitler and his Nazi party were the two Germans who sat on the BIS board: Baron Kurt von Schröder, an elite private banker who was one of the largest funders of Hitler’s rise to power, and Hjalmar Schacht, soon to be the Nazi finance minister.[5] The BIS itself provided financial support for the Nazis, including by holding the gold they looted from throughout Europe.[6] Because of its Nazi ties, the BIS was supposed to be disbanded as part of the Bretton Woods financial arrangements at the end of World War II, but after the death of President Franklin Roosevelt in April 1945 the BoE-centred financial oligarchy managed to keep it in place.

Though based in Basel, Switzerland, the BIS has extraterritorial status and is therefore responsible to no nation. It serves as the “neutral” conduit through which the BoE orchestrates fascist international regulatory policies today. For example, the British were instrumental in the creation of the Financial Stability Board as ostensibly a G20 body (formalised at the 2009 G20 summit in Pittsburgh), but de facto an arm of the BIS. The FSB’s first chairman, who had headed its pilot project, the Financial Stability Forum, since 2006, was then-Governor of the Bank of Italy Mario Draghi, fresh from three years working in London as managing director of Goldman Sachs International. Today, as head of the ECB, Draghi is helping to oversee bail-in throughout the EU, even while opening the sluice gates for huge new “quantitative easing” bailouts of Europe’s TBTF banks.

Mark Astaire, vice chairman for investment banking of Barclays Bank (the very bank with which Tucker’s ties got him in trouble over LIBOR), summed up the decisive role of the UK financial oligarchy in the supranational regulatory mafia, in testimony to the UK House of Commons Treasury Select Committee in early 2016. The Telegraph of 6 January 2016 reported: “He added that Britain generally has a strong negotiating position on financial regulations, which are created by global organisations such as the G20, Financial Stability Board and Basel [the BIS] before being passed down to nations.” (Emphasis added.)

What about My Deposit Guarantee?

“But surely they can’t grab all my money?!”, you might protest. “What about my deposit guarantee?” The Financial Claims Scheme (FCS) in Australia is supposed to guarantee deposits up to $250,000, while the Financial Services Compensation Scheme (FSCS) in the UK guarantees deposits up to £75,000 (lowered from £85,000 in 2015). In reality, both schemes are worthless, as are similar ones in the United States and the EU.

Against some $950 billion in insured deposits, Australia’s FCS makes provision for paying out only $20 billion in insurance on deposits in any single troubled bank, even though each of the Big Four has around $200 billion in insured deposits. Even APRA and the FSB admit that this level is woefully inadequate for the eventuality of a failure of any of the Big Four banks. According to the minutes of the Australian Council of Financial Regulators 19 June 2009 meeting, when discussing the deposit guarantee scheme “APRA noted ... failure by one of the four largest institutions would be likely to exceed the scheme’s resources.” The FSB’s own 21 September 2011 Peer Review of Australia Report stated, “The limit of $A20 billion per ADI [Authorised Deposit-taking Institution] would not be sufficient to cover the protected deposits of any of the four major banks”.

Moreover, the relevant authorities have admitted that they will grab the resources of deposit insurance schemes, if they deem that necessary to keep the TBTF banks afloat. The U.S. FDIC and the Bank of England, for instance, issued a joint paper on 10 December 2012, stating: “The UK has also given consideration to the recapitalisation process in a scenario in which a G-SIFI’s liabilities do not include much debt issuance at the holding company or parent bank level [i.e., “bail-in bonds”] but instead comprise insured retail deposits held in the operating subsidiaries. Under such a scenario, deposit guarantee schemes may be required to contribute to the recapitalisation of the firm”.

Paul Tucker pushed the point in a speech to the Institute of International Finance on 12 October 2013, just before quitting the Bank of England, stating that “if the losses are vast enough, then the haircuts imposed by the resolution authority can in principle permeate to any level of the creditor stack. In the case of insured deposits, that means Deposit Guarantee Schemes suffering losses.”

Behind Bail-in: Eugenics and Genocide

A glimpse into the policy that underlies bail-in is afforded by examining the UK’s Centre for Policy Studies (CPS), whose City of London backers conceived the bail-in policy to begin with. In a January 2016 study titled The Abolition of Deposit Insurance: A modest proposal for banking reform, the CPS calls for the cancellation of deposit insurance altogether, as was done in New Zealand in 2011 and in Austria in 2015 under the approving eye of the EU. Since its founding in 1974, the CPS has specialised in floating seemingly outrageous “free market” proposals, which soon become law.

The entire global think-tank apparatus of which the CPS is a key part, and which designed the present deadly policies of privatisation, deregulation, and austerity in a hundred different guises, was spawned from the Crown/City of London front organisation known as the Mont Pelerin Society (MPS). The foremost MPS offshoot, the Institute of Economic Affairs (IEA), was established in 1955 with the backing of Harley Drayton, personal financier for the British Crown. From its inception, the IEA was viciously opposed to the policies of post-war British PM Clement Attlee, which favoured the general welfare.

The IEA, in turn, spun off the CPS and the legions of similar “free market” think tanks that have dictated government policy throughout the Anglo-American world since the Thatcher regime came to power in the UK in 1979, including emphatically in Australia and New Zealand.[7] These organisations have never been anything but fronts for the Crown and its allies in the powerful, super-secretive City of London Corporation, which provides much of their copious funding. The intellectual author of this global apparatus was Friedrich von Hayek, sometime adviser to Chilean fascist Gen. Augusto Pinochet, and a chief propagandist for the pro-feudalist, pro-empire and anti-nation-state “Austrian School” of economics. The day von Hayek was made a Companion of Honour by the Queen for his work, one of only 60 people worldwide accorded that status, he proclaimed to be “the proudest day of my life”.

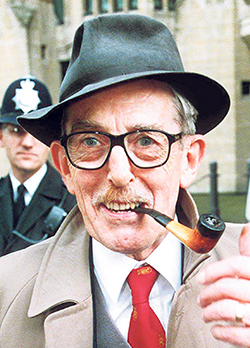

Behind the veneer of free-market ideology promoted by these think tanks lies an even uglier reality: eugenics. The IEA’s long-time leader Sir Ralph Harris was a fellow of the British Eugenics Society, and his two protégés who were in charge of the CPS, Sir Keith Joseph and Alfred Sherman, were fanatical eugenicists as well. Harris even observed in a PBS interview that Sherman, top policy designer for CPS, constantly wanted to “bring in issues like immigration or eugenics.”[8] In all his policy proposals, Sir Keith Joseph was actually speaking on behalf of the City of London Corporation, for which his father had been Lord Mayor, and which he himself had served as an alderman. In the 1970s, Sir Keith had been slated to be the next head of the Conservative Party—and therefore Britain’s prime minister—upon the success of the IEA/CPS “free market” coup in the Tories in 1975, in which CPS official Margaret Thatcher was a leading figure. But Joseph delivered such an overtly pro-eugenics speech in Birmingham on 19 October 1974, that the resulting uproar forced him to step aside in favour of Thatcher.[9]She, for her part, famously said of Sir Keith, “I could not have become leader of the opposition, or achieved what I did as prime minister, without Keith.” The eugenics scandal notwithstanding, the Queen in 1986 made Joseph a Companion of Honour, just like his idol von Hayek.

Lord Harris observed about Thatcher, “We weren’t Thatcherites, she was an IEA-ite”. The policy of “austerity”, by which the Crown and the City of London ripped up the post-war settlement of a regulated economy devoted to the common good, to which both Labour and the Conservatives had subscribed from the time of Attlee’s “Old Labour” Government in 1945 until the IEA/CPS coup in the Tories in 1975, is at root a policy of eugenics, of mass murder, as the bail-in regime makes clear. With the advent of Tony Blair and New Labour, the City of London took over the Labour Party as well, a reality summarised in a 10 May 1999 New Statesman article about Sir Keith Joseph.[10]

Quite lawfully, given its City of London backing, the CPS provided many crucial figures of the Thatcher regime.

Many members of the City of London’s CPS mafia, representing the highest levels of the blood aristocracy and financial oligarchy in the UK, have held key posts in or otherwise influenced the Tory Governments of David Cameron and Theresa May, promoting the implementation of more of the think tank’s “studies”—like the one on abolishing all deposit insurance.

Some of the past and present leading lights of the board and advisory council of the Centre for Policy Studies are these City of London and Crown-connected people:

Lord Maurice Saatchi, CPS chairman, was campaign director for Thatcher in 1979 and Cameron in 2010, and has been an adviser to Australian PM and former Goldman Sachs executive Malcolm Turnbull.

Tessa Keswick, who assumed the post of CPS deputy chairman in 2004 after having been executive director of the CPS since 1995, is the daughter of Scottish aristocrat Simon Fraser, 15th Lord Lovat, and the wife of Henry Keswick, one of Britain’s richest men and chairman of Jardine Matheson Holdings, historically a kingpin of the British Far East opium trade. When Keswick was brought in under the sponsorship of then-CPS chair Lord Griffiths of Fforestfach, who had headed Thatcher’s Policy Unit, she was intended as “the intellectual heir to Sir Keith Joseph”, as the Independent put it on 10 September 1995.

Lord George Bridges of Headley was formerly chairman of the Conservative Party Research Department, and the party’s campaign director in 2006-07. From 2010 to 2013, he headed Quiller Consultants, PR firm for the City of London Corporation. In 2015 he became parliamentary secretary for the Cabinet Office, a post whose occupant officially (www.gov.uk) “supports the Chancellor of the Duchy of Lancaster[11] in ensuring that the government delivers its policy agenda”. Since 2016 he has been parliamentary under-secretary of state for exiting the European Union.

Oliver Letwin, who was a close adviser of Conservative Prime Minister David Cameron, also served as Chancellor of the Duchy of Lancaster in 2014-16. Letwin’s mother, Shirley Letwin, was a former student of von Hayek at the University of Chicago and helped establish the CPS when “Keith Joseph, Milton Friedman and other right-wing thinkers and politicians came to dinner at the Letwin residence in London.”[12] A member of Thatcher’s Policy Unit in 1983-86, her son Oliver has advocated CPS policies for decades within the Conservative Party (including as chairman of the Conservative Research Department). He co-authored the 1988 CPS paper “Britain’s Biggest Enterprise—ideas for radical reform of the NHS [National Health Service]” with John Redwood, and the same year wrote Privatising the World: A Study of International Privatisation in Theory and Practice (London: Cassell, 1988).

Andrew Knight, chairman of J Rothschild Capital Management, is also a director and former chairman of Rupert Murdoch’s News Corporation.

Richard Sharp, a 23-year veteran of Goldman Sachs, is a derivatives specialist worth £100 million. Despite a scandal over a conflict of interest, he was appointed in 2013 a member of the Bank of England’s Financial Policy Committee. Earlier he chaired the Huntsworth lobbying and PR firm, whose subsidiary Quiller Consultants had handled promotional work for the City of London Corporation.

Lord Flight, who worked in the City of London first at NM Rothschild & Sons and then at HSBC, was the Conservative Party’s deputy chairman and special envoy to the City of London in 2004-05.

Lord Griffiths of Fforestfach, currently vice-chairman of Goldman Sachs International, was a director of the Bank of England for two years in the 1980s, went on to head Thatcher’s Policy Unit in 1985-90, and chaired the CPS in 1991-2001.

Lord Powell of Bayswater, private secretary to Margaret Thatcher and to her successor as Tory leader and PM, John Major. Under Thatcher he helped set up the largest arms deal in history, the infamous al-Yamamah deal with Saudi Arabia, used to fund the rise of al-Qaeda and ISIS.

The Royal Policy of Eugenics

The Queen attended Margaret Thatcher’s funeral in 2013, the only occasion since her coronation in 1952 upon which she has attended the funeral of a non-Royal or non-relative, excepting the funeral of Winston Churchill. Whatever minor personal spats Elizabeth may have had with Thatcher, the Iron Lady’s brutal policies were Royal ones as well, in particular eugenics, which has been the guiding policy of the Crown ever since Edward VII knighted Sir Francis Galton, founder of the “science of eugenics”, in 1909.

The Royal family’s personal physicians served as top officials of the British Eugenics Society, the activities of which predated by some decades those of Hitler and his Nazis, for whom they otherwise had clear sympathy, not merely through the notorious Edward VIII, but through Elizabeth’s own father King George VI as well, not to mention Prince Philip’s own intimate family relations with top Nazi officials.

After the Second World War, when the revelation of Nazi concentration camp policies had “discredited” the overt advocacy of eugenics, the policy was repackaged under different labels, such as “world overpopulation”. Writing in 1945 as chairman of UNESCO, co-founder—with Prince Philip—of the World Wildlife Fund and President of the British Eugenics Society Sir Julian Huxley lamented that Hitler’s eugenics-centred policy of mass genocide had momentarily given eugenics a bad name. The policy must continue, he argued, albeit under other guises: “Thus even though it is quite true that any radical eugenic policy will be for many years politically and psychologically impossible, it will be important for UNESCO to see that ... the public mind is informed of the issues at stake so that much that is now unthinkable may at least become thinkable.” In her Christmas Broadcast of 1964, the Queen herself declared “overpopulation” to be the world’s single greatest problem, while Prince Philip has expressed his desire to be reincarnated “as a deadly virus in order to contribute something to solve overpopulation”, as he put it to the German Press Agency in 1988.[13]Can anyone really believe that this man who has personally slaughtered untold members of endangered species, actually intended to “save the world’s wildlife”?[14]

Whether they are sold through calls for ever greater “austerity” and “free market reforms”, or under the rubric of ultra-radical “green” policies, the result of reconfigured eugenics policies is the same—destruction of the agro-industrial base upon which the survival of the world’s population depends. Elimination of the “lower classes”, whether at home or throughout the Empire, has been British oligarchical policy, from at least the time when PM William Pitt the Younger commissioned Parson Thomas Malthus to write a tract to justify eliminating the already grossly inadequate “Poor Laws”, with predictably murderous results.[15]

Where Does Queen Elizabeth Stand on Bail-in?

Our brief dossier, above, on the Royal Family’s eugenicist traditions and the close ties between the Crown, the City of London and the think tanks that created the bail-in scheme already suggests what the answer to that question is, but it is important to ask it specifically. Contrary to the nonsense peddled by self-deluded suckers that “the Queen is above politics and acts only on the advice of her ministers”, in fact the Crown and its Privy Council sit at the centre of all UK and Commonwealth politics, and Her Majesty intervenes whenever and wherever she feels she has to, a reality of which Australians have had bitter experience. When Prime Minister Gough Whitlam and his “Old Labor” party came to power in 1972, it was with the openly stated intention to “buy back the farm”, to regain control over Australia and its vast resources from the London-centred mining cartel typified by Rio Tinto (in which the Queen herself was the largest single private shareholder), in order to develop the continent through great projects in manufacturing, agriculture and infrastructure. Terrified at the prospect of an actually sovereign Australia, Queen Elizabeth acted from behind the mask of her Governor-General Sir John Kerr, and in conjunction with Prince Charles personally directed every step of the process leading to the sacking of Whitlam in 1975. It is also not unknown in the UK itself, to speak openly about the Crown’s political interventions. In the months before his sudden resignation the year after Whitlam was sacked in Australia, British PM Harold Wilson charged that the Crown and Lord Mountbatten were out to overthrow him.

Elizabeth and Charles have also repeatedly intervened in legislation on a variety of matters, as reported in a 15 January 2013 article in the Guardian about the Freedom of Information request filed by legal scholar John Kirkhope. “There has been an implication that these prerogative powers are quaint and sweet, but actually there is real influence and real power, albeit unaccountable”, is how Kirkhope summed up the revelations wrung from the Royals.

Particularly sensitive to the Crown are any matters affecting the multibillion-pound holdings of the Queen and Prince Charles, the Duchies of Lancaster and Cornwall, respectively, which are major financial powers in their own right. The councils responsible for oversight of these duchies are packed with City magnates, making them an important interface between the Crown and the City.

A case in point was the 2008 bailout of the City’s TBTF banks. In their 19 October 2008 account of how PM Gordon Brown arranged the matter, “Britain’s £500bn banking bail-out: The inside story of a dramatic week”, the Telegraph’s Louise Armitstead and Philip Aldrick reported that the plan was hatched in the London offices of that old lynchpin of the Empire, Standard Chartered Bank, one weekend in October. Chosen to run the bailout, pouring untold billions into the banks, was Credit Suisse’s London head, James Leigh-Pemberton. The son of 1983-93 Bank of England Governor Sir Robin Leigh-Pemberton, James had been a personal protégé of the leading London financier of the post-war period, Sir Siegmund Warburg, inventor of the Eurodollar market and of hostile corporate takeovers, as well as an architect of the EU and the simultaneous rise of the City of London as a virtually lawless, “offshore” world banking power. Many of those present, such as Brown’s long-time aide and top financial adviser Baroness Shriti Vadera, had also been associated with S.G. Warburg, but bailout chief James Leigh-Pemberton wore another hat as well—that of receiver-general for Prince Charles’s Duchy of Cornwall. This post reflected the Leigh-Pembertons’ close relations with the Crown, dating back to the mid-19th century when a family member served as the chief legal gun for the Duchy. Often referred to as “Prince Charles’s financial advisor”, James by his own account is one of the big movers behind the plan for an “ultimate convergence of the U.S. and EU capital markets”, which is now happening under the BoE/BIS fascist international regulatory apparatus, currently focused on bail-in.

The Australian banking regulator APRA, identified above for its dictatorial control over the bail-in process in Australia, is an unelected, secretive body established in 1998 as a de facto subsidiary of the BoE’s Prudential Regulation Authority and the BIS. Its officials are appointed by the Crown through the governor-general of Australia. APRA boss Wayne Byres is a former chairman of the BIS’s Basel Committee on Banking Supervision, which specified in the bland, technocratic jargon of its September 2012 “Core Principles for Effective Banking Supervision”, that there must be “no government or industry interference that compromises the operational independence of the supervisor.”

FOOTNOTES

[1]. Christopher Joye, “Ensuring the major banks are not too big to fail”, Australian Financial Review, 20 Dec. 2015, summarised the Australian bank regulator APRA’s assertion that even without special bail-in legislation it already had bail-in powers under existing Australian law.

[2]. The CCitizens Party’s “Glass-Steagall Now!” web page www.cecaust.com.au/bail-in details how derivatives work, and the history of their formerly illegal status in the USA, Australia, and most other countries.

[3]. Ross Gittins, “Banks are using us to hedge their bets”, Sydney Morning Herald, 2 Feb. 2016, reported that the well-known Oxford economist John Kay, addressing a meeting organised by the Grattan Institute on 1 Feb. during his tour of Australia, emphasised that only 3 per cent of the loans made by TBTF banks go to the real economy. Summarising Kay’s presentation, economics editor Gittins wrote: “We need a financial sector to service the needs of the ‘real economy’ of households and businesses producing and consuming goods and services. But none of this justifies the huge growth in the financial sector we’ve seen. Most of that growth has come in the form of massively increased trading between the banks themselves in ‘financial claims’, such as shares and bonds and foreign currencies and ‘derivatives’ (claims on claims, and even—if you’ve seen The Big Short [film]—claims on claims on claims). If you add together all the financial assets (‘claims’) owned by all the banks and other financial outfits, they exceed by many times the value of the physical assets—such as houses and business buildings and equipment—which are the ultimate basis for all those claims.”

John Kay, “Don’t always believe a balance sheet”, Financial Times, 16 Feb. 2016, amplified the point with some data on derivatives: “Two banks, JP Morgan and Deutsche Bank, account for about 20 per cent of total global derivatives exposure. Each has more than $50tn [trillion] potentially at risk. The current market capitalisation of JP Morgan is about $200 billion (roughly its book value). ... From one perspective, Deutsche Bank is leveraged 2,000 times. Imagine promising to buy a house for $2,000 with assets of $1.”

[4]. The Reserve Bank of New Zealand’s Open Bank Resolution is a ruthless bail-in scheme that blatantly targets all bank deposits, which in New Zealand have no government guarantee.

[5]. Carroll Quigley, Tragedy and Hope: A History of the World in Our Time (New York: Macmillan, 1966), described the establishment of the BIS by a cartel of central bankers with Montagu Norman at its head: “In the 1920s they were determined to use the financial power of Britain and of the United States to force all the major countries of the world to go on the gold standard and to operate it through central banks free from all political control, with all questions of international finance to be settled by agreements by such central banks without interference from governments. … In addition to these pragmatic goals, the powers of financial capitalism had another far-reaching aim, nothing less than to create a world system of financial control in private hands able to dominate the political system of each country and the economy of the world as a whole. This system was to be controlled in a feudalist fashion by the central banks of the world acting in concert, by secret agreements arrived at in frequent private meetings and conferences. The apex of the system was to be the Bank for International Settlements in Basle, Switzerland, a private bank owned and controlled by the world’s central banks which were themselves private corporations. Each central bank, in the hands of men like Montagu Norman of the Bank of England, Benjamin Strong of the New York Federal Reserve Bank, Charles Rist of the Bank of France, and Hjalmar Schacht of the Reichsbank, sought to dominate its government by its ability to control Treasury loans, to manipulate foreign exchanges, to influence the level of economic activity in the country, and to influence cooperative politicians by subsequent economic rewards in the business world.”

[6]. “Defeat the Synarchy—Fight for a National Bank”, New Citizen, April 2004, (www.cecaust.com.au/ncv5n5.html) details the Australian side of this banker-fascist alliance in the 1930s, when financiers created the mass-based fascist Old and New Guard armies to stop Labor from reasserting its tradition of national banking to revive the economy and alleviate mass suffering.

[7]. The 1998 CEC pamphlet Stop the British Crown Plot to Crush Australia’s Unions (www.cecaust.com.au/StopCrownPlot/) documented the extension of this policy-making think tank web in Australia.

[8]. Interview of Lord Ralph Harris, U.S. Public Broadcasting Service “Commanding Heights” program, 17 July 2000.

[9]. Though Joseph’s speech was largely written by his fellow eugenics advocate Alfred Sherman, the most outrageous phrases were inserted by Sir Keith himself. These included the statement that “our human stock is threatened”—the title under which the transcript remains posted to this day. Joseph continued: “… a high and rising proportion of children are being born to mothers least fitted to bring children into the world and bring them up. ... Some are of low intelligence, most of low educational attainment. … They are producing problem children, the future unmarried mothers, delinquents, denizens of our borstals, sub-normal educational establishments, prisons, hostels for drifters. ... A high proportion of these births are a tragedy for the mother, the child and for us.”

[10]. Charles Leadbeater, “New Labour’s secret godfather”, The New Statesman, 10 May 1999. Speaking of Joseph, the article began, “He was Margaret Thatcher’s Mad Monk, the high priest of the free market, the first true believer who converted the future prime minister to radical right-wing ideas. ... It is uncanny how many of the themes of the new Labour government were prefigured in his speeches and pamphlets (which are still available from the Centre for Policy Studies). … What new Labour ingested from Joseph above all … was the recognition that the post-war consensus, and everything that went with it, was gone for ever.”

[11]. The Duchy of Lancaster is a major private estate of the Queen, which is formally administered by government officials such as the ones cited here.

[12]. Andy Beckett, “More Mr Niceguy”, Guardian, 6 Oct. 2003.

[13]. “The British Crown Created Green Fascism”, New Citizen, Oct./Nov./Dec. 2011, (www.cecaust.com.au/NC_07_06.html) is a CEC special report including a detailed history of the relations of Huxley and his fellow eugenics fanatic Privy Council Secretary Max Nicholson, with the Crown.

[14]. The True Story behind the Fall of the House of Windsor, EIR Special Report, 1997, documented the murderous nature of Prince Philip and his WWF, including through such crimes as their sponsorship of the mass slaughter of game in Africa, the use of private mercenary armies to incite “divide-and-conquer” wars within and among African nations, and locking up huge swathes of the continent’s raw materials in supranationally administered “game parks”.

[15]. In his Essay on the Principle of Population (1798, with subsequent expanded editions), Malthus defined an imperial economic system that required mass population reduction: “All the children born beyond what would be required to keep up the population to this level, must necessarily perish, unless room be made for them by the deaths of grown persons. … [T]herefore, we should facilitate, instead of foolishly and vainly endeavouring to impede, the operations of nature in producing this mortality; and if we dread the too frequent visitation of the horrid form of famine, we should sedulously encourage the other forms of destruction, which we compel nature to use. … But above all, we should reprobate specific remedies for ravaging diseases, and those benevolent, but much mistaken men, who have thought they were doing a service to mankind by projecting schemes for the total extirpation of particular disorders.”

The British East India Company (BEIC), which was the core of the British Empire, founded Haileybury College in 1805 to train its officials, and installed Malthus there as the world’s first lecturer in political economy. For several decades he indoctrinated the BEIC’s imperial administrators in the policies and rationale for mass genocide, which are still the essence of British imperial policy today. Implemented most notably in Ireland and India, they resulted in the deaths of tens of millions of people. Malthus’s ideas are cited today by Prince Philip and his toadies as the “scientific” rationale for the Royal family’s agenda of reducing the world’s population to less than one billion people, including through the global green movement. Hitler credited Malthus as the source of his own mass-murderous policies of “race science”.

Ann Lawler (CEC national chairman), “The Humbuggery of Charles Darwin”, New Citizen, Oct./Nov. 2011, contains an exposition and refutation of the theories of Malthus, including as they were popularised by the quack scientist cum eugenicist Charles Darwin.